8 Real Estate Pipeline Software Tools Transforming How Agents Close Deals

By: Jennifer Villalba

Missed calls, misplaced docs, and fuzzy next steps can kill a deal before it starts. Real-estate pipeline software plugs those cracks by turning chaos into a clear, step-by-step flow you can glance at between showings.

Yet “pipeline” isn’t universal. An agent chasing Zillow leads needs a different dashboard than an acquisitions team sizing up a $50 million tower, and neither should wade through tools built for the other.

In this guide, we map those distinct lanes and compare eight proven platforms, CRMs, deal suites, and transaction trackers, so you can choose the right fit and keep every deal moving.

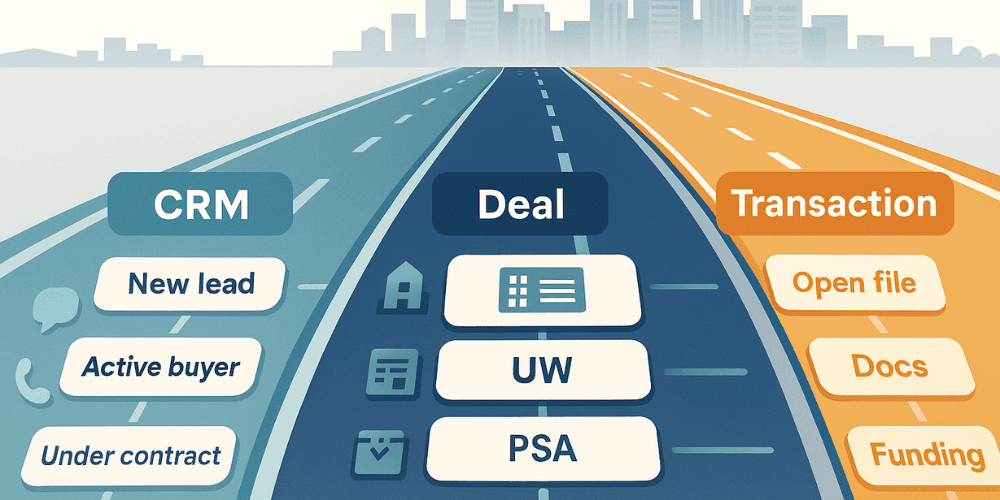

Choose Your Lane Before You Merge

Your daily workflow shows which pipeline you need.

Call new internet leads in the morning and text past clients at night, and you’re in the client-relationship lane. Contacts, follow-ups, and clear stages (New lead, Active buyer, Under contract) belong in a CRM.

Sketch cap rates and development timelines on the whiteboard, and you’re working on a deal pipeline. The property, not the person, is the hero, so underwriting, due diligence, and investment-committee sign-offs demand deep data and tight collaboration.

Push three, five, or ten closings toward payday each week, and you’re in the transaction lane. The handshake is done; checklists, deadlines, and commission math now run the show, and a transaction platform keeps every box ticked.

Think of these three lanes as parallel highways with different speed limits. Pick yours now, and the rest of our real-estate pipeline software guide will feel like GPS, not guesswork.

At A Glance: Eight Real-Estate Pipeline Platforms Side By Side

Need the quickest way to shortlist real-estate pipeline software? The snapshot below maps each tool to its lane, shows the view you’ll use every day, and flags pricing and trial hurdles before you book a demo.

| Tool (lane) | Pipeline view | Standout edge | Key analytics | Notable integrations | Trial |

| Buildout (CRM) | Kanban + list | 8.5 million-record CRE prospect database with AI owner lookup | Deal volume, client activity | Outlook, Gmail, Salesforce | Demo |

| BoomTown (CRM) | List + activity feed | IDX website plus in-house ad management | Lead ROI, agent response speed | Zillow leads, Facebook Ads, Brokermint | Demo |

| Follow Up Boss (CRM) | Drag-and-drop board | Built-in dialer and texting | Conversion by source, projected GCI | 250 + apps, Paperless Pipeline | 14 days |

| Pipedrive (CRM) | Visual Kanban | Simple setup for solos or small teams | Win rate, revenue forecast | Zapier, Gmail, Outlook | 14 days |

| Dealpath (Deal) | Custom stages grid | AI Studio auto-ingests OM data | Pipeline value, stage velocity | ARGUS, Salesforce API | Demo |

| Altrio Origin (Deal) | List + task timeline | Dual deal- and capital-raising modules | Portfolio trend dashboards | Email parsing, investor portals | Demo |

| Brokermint (Transaction) | Status dashboard | Commission automation with QuickBooks link | Agent cap progress, GCI | DocuSign, Dotloop, BoomTown | Demo |

| Paperless Pipeline (Transaction) | Simple list | Pay-per-deal, unlimited users | Checklist-compliance reports | Follow Up Boss embed | 14 days |

†Pricing reflects publicly posted entry tiers as of November 2025; verify current rates during your demo.

Keep this cheat sheet open while you read the deep-dive reviews. The moment a tool falls short in a must-have column, cross it off and move on.

CRM Pipeline Software: Turning Conversations Into Closings

Client-relationship pipelines live and die by two metrics: speed to response and consistency of follow-up. We found four CRMs that address those pressures in distinct ways, from AI prospecting for commercial brokers to built-in dialers for residential teams.

-

Buildout (Rethink CRM) & Showcase— Built For Commercial Brokers

Buildout links people, properties, and deals in one view, then lets you mine a verified database of 8.5 million U.S. CRE records. Drag a listing from Marketing to Under LOI, and required tasks appear automatically while managers watch projected fees update in real time. Pricing starts around $129 per user per month; schedule a demo to see owner-lookup and brochure tools in action. Pick Buildout if off-market prospecting drives your growth.

Rethink handles the deal and contact pipeline, while Buildout Showcase manages the marketing front-end—turning property data into polished brochures, proposals, and live websites with one click. The two connect seamlessly, so listings created in Showcase flow directly into the CRM, giving brokers a full loop from marketing to pipeline tracking without duplicate entry.

-

Boomtown — CRM Plus Done-For-You Lead Generation

BoomTown pairs an IDX website with managed Google and Facebook ads, then routes every new lead into an activity feed that flags “hot” visitors. Dashboards expose agent response speed and ad-spend ROI, making coaching data-driven. Expect entry packages near $1,000 a month plus setup fees. That cost makes sense only if your team can handle a high volume of online leads.

-

Follow Up Boss — Communication Hub For Residential Teams

Follow Up Boss drops Zillow or Facebook leads into a shared inbox, auto-assigns them, and sends a text within seconds. A drag-and-drop board shows each buyer’s stage and projected commission, while the built-in dialer and SMS keep every touch logged. Pricing begins at $69 per user per month with a 14-day full-feature trial. Choose FUB when you already have lead flow and need accountability, not another website.

-

Pipedrive — Visual Discipline For Solo Agents And Small Teams

Pipedrive’s empty Kanban board invites you to define stages and start dragging cards without hiring consultants. Automations trigger reminders when a deal sits idle, and an AI assistant surfaces neglected leads. Plans range from $15 to $99 per user per month, and the 14-day trial is plenty to test whether its minimalist workflow fits your style. Use Pipedrive when you crave order but not overhead.

Deal Pipeline Softwares: Keeping Investment Teams Aligned

Analyzing a $50 million tower isn’t the same as chasing a residential listing. In the deal-pipeline lane, the asset, not the person, is the hero, and every stakeholder needs real-time data on underwriting, due diligence, and committee approvals. We dug into two platforms that replace scattered spreadsheets with one workspace built for institutional collaboration.

-

Dealpath — Institutional Deal-Pipeline Software From Sourcing To Close

Large-ticket deals collapse when data hides in version 9 spreadsheets. Dealpath turns that risk into a live, searchable database every stakeholder can trust.

- AI data ingestion. Upload a broker flyer, and Dealpath AI Studio extracts address, square footage, tenants, and key financials in under one minute with 95% accuracy.

- Stage-driven automation. Custom lanes (Sourcing → Initial underwrite → IC approval → PSA negotiation) launch task checklists automatically, while dashboards surface volume, cycle time, and projected equity needs so a CIO can scan 40 deals before breakfast.

- Enterprise integrations. Push valuations to ARGUS, sync contacts to Salesforce, or stream final numbers to Snowflake via API; the platform becomes a single source of truth for audit teams and investors.

- Pricing. Quote-only. If your team reviews more than a few assets each quarter, one missed deadline could cost more than the license.

Choose Dealpath when accountability, data integrity, and execution speed decide whether a deal lives or dies.

-

Altrio Origin — Tracks Dollars As Closely As Dirt

Origin calls itself “everything your investment team needs in one browser tab,” and the feature mix supports the claim.

- One feed for every opportunity. Email parsing or a web clipper drops new deals (address, asset type, seller) straight into the pipeline. Analysts tag each record by strategy so leadership can slice data any way they like.

- Capital and deals in a single view. A built-in capital-raising module logs equity commitments and debt quotes alongside underwriting, removing the “Funding-v6-FINAL” shuffle.

- Workflow automation. Moving a deal to due diligence triggers preset tasks for legal, insurance, and construction. Miss a deadline, and Origin escalates alerts until the bottleneck clears.

- Fast interface. Dashboards load in seconds; adding a custom metric is click-and-type. Early adopters, including several global pension funds (Altrio press release, October 2025), report screening 100+ deals per week without feeling buried.

- Pricing. Quote-only. Origin fits firms that juggle acquisitions and fundraising; consolidating those workflows can replace three separate tools.

Choose Origin when you want an AI-ready deal-pipeline platform that unifies data, workflow, and capital tracking in one tab.

Transaction & Commission Pipeline Software: Closing Files, Paying Agents

Once buyer and seller shake hands, the real work begins: checklists, compliance deadlines, and complex commission math. Transaction-management platforms turn that chaos into a step-by-step pipeline, time-stamping every document and calculating every dollar so deals close on schedule and agents get paid without spreadsheets. We reviewed two standouts.

-

Brokermint — Real-Estate Back Office In One Dashboard

Brokermint turns closing chaos into a checklist you can track at a glance.

- Checklist-driven files. Upload a contract, and Brokermint time-stamps the doc, then prompts the next item (agency disclosure, HOA addendum, and more). A live dashboard flags stalled tasks so managers can unblock deals quickly.

- Commission automation. Enter the sale price once; Brokermint applies each agent’s split plan, cap, referral fee, or franchise royalty, then pushes approved numbers to QuickBooks.

- Built-in e-sign and docs. Send forms through DocuSign or Dotloop and watch compliance status turn green without downloading a PDF. Agents see pending deals, earned GCI, and progress toward cap in their portal.

- Pricing. Plans start at $99 per month for the Simple Start tier and scale to $239 for Enterprise.

Choose Brokermint when you need transaction tracking, commission accounting, and multi-office reporting in one real-estate transaction-management platform. It turns paperwork into a predictable production line.

-

Paperless Pipeline — Transaction Checklists Without The Per-User Tax

Traditional back-office tools bill per seat; Paperless Pipeline bills per deal. You pay for new transactions each month while adding unlimited users for free. Ten deals cost $120, 25 deals $160, and 40 deals $200.

- Clean, automated checklists. Open a file to see every required doc; key dates such as inspection or loan approval auto-calculate from the contract, and overdue items turn red until the missing form lands. Auditors appreciate the time-stamped trail.

- Built-in commission math. Enter the sale price once, and the system calculates splits, referral fees, and disbursement instructions. Agents can download their statements the moment a file flips to Closed.

- Lightweight integrations. Agents forward signed PDFs via unique email-in addresses, and a Follow Up Boss embed lets them check status from inside their CRM.

Paperless Pipeline shines when you juggle dozens of deals but refuse to fund dozens of logins. If missing paperwork, not complex accounting, is your main headache, this real-estate transaction-management platform works like a digital coordinator.

Real-Estate Pipeline Software Trial Checklist

Demos show polish, but only a real trial reveals how a platform fits your workflow. Use live deals and contacts, not sample data, to test core tasks like moving listings through stages, linking people to properties, and generating pipeline reports. Make sure setup feels intuitive, automations trigger correctly, and metrics like conversion rate or commissions appear without digging through menus.

Extend the test to daily realities: upload documents from your phone, sync email, invite teammates with proper permissions, and simulate missed deadlines to see how the system alerts you. Finally, export your data and check pricing against expected growth. A strong platform should handle all this smoothly while cutting clicks, not adding them.

Conclusion

Pipeline software doesn’t just track deals; it shapes how efficiently your business runs. Whether you manage residential leads, commercial portfolios, or post-contract checklists, the right platform eliminates guesswork and keeps revenue visible in real time. Use trials to see where each tool accelerates or stalls your workflow. When your software mirrors how your team actually sells, every stage, lead, deal, or closing moves faster and with fewer surprises.